reverse tax calculator ontario

Tax rate for all canadian remain the same as in 2017. Amounts 90287 up to 150000 the rate is 1116.

Provide a written undertaking to the court stating that you will within six.

. Select Your State Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Nova Scotia Northwest Territories Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon. This simple PST calculator will help to calculate PST or reverse PST. Who the supply is made to to learn about who may not pay the GSTHST.

In certain circumstances the estate administration tax paid may be calculated on an estimated value of the estate. See the article. Current Provincial Sales Tax PST rates are.

Calculating estate administration tax on an estimated estate value. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. An 8 provincial.

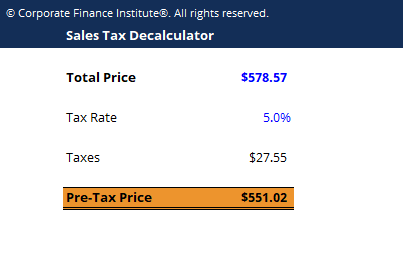

If you know the total sales price and the sales tax percentage it will calculate the base price before taxes and the amount of sales. The rate you will charge depends on different factors see. Here is how the total is calculated before sales tax.

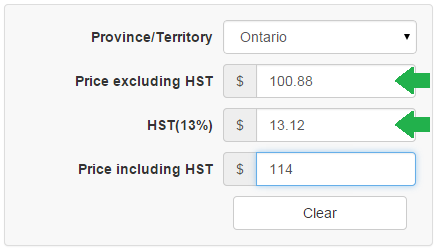

Provincial federal and harmonized taxes are automatically calculated for the province selected. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. Calculates in both directions get totals from subtotals and reverse calculates subtotals from totals.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Enter HST value and get HST inclusive and HST exclusive prices.

Type of supply learn about what supplies are taxable or not. Current HST GST and PST rates table of 2022. Where the supply is made learn about the place of supply rules.

Current GST and PST rate for British-Columbia in 2022. The HST was adopted in Ontario on July 1st 2010. Reverse sales tax calculator ontario Friday March 18 2022 Edit.

ADP Canadian Payroll Tax. The only thing to remember in our Reverse Sales. This calculator can be used as well as reverse HST calculator.

The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada rate 5 for a total of 12. This is very simple universal HST calculator for any Canadian province where Harmonized Sales Tax is used. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax.

This is very simple HST calculator for Ontario provinceAny input field can be used. Earnings 150000 up to 220000 the rates are 1216. Just set it to the HST province that you want to reverse and enter in the after-tax dollar amount that you want to reverse.

An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces with high accuracy. Sales Taxes in Ontario. Amount without sales tax QST rate QST amount.

New Brunswick Newfoundland and Labrador Nova Scotia Ontario Prince Edward Island HST Tax Rate. Select the province you need to calculate HST for and then enter any value you know HST value OR price including HST OR price exclusive HST the other values will be calculated instantly. Ontario 2022 Tax Tables with Federal Provincial and Territorial personal income tax rates and tax credits.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. To start complete the easy-to-follow form below. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

Scroll down to use it online or watch the video demonstration. Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. Enter HST inclusive price and calculate reverse HST value and Harmonized sales tax exclusive price.

Finally earnings above 220000 will be taxed at a rate of 1316. Use this simple powerful tool whether your employees are paid salary or hourly and for every province or territory in Canada. The payroll calculator from ADP is easy-to-use and FREE.

The HST is made up of two components. It ranges from 13 in Ontario to 15 in other provinces and is composed of a provincial tax and a. Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week and has worked 52 weeks during the year.

Amounts earned up to 45142 are taxed at 505. Current HST rate for Ontario in 2022. It is perfect for small business especially those new to payroll processing.

Amount without sales tax GST rate GST amount. Enter price without HST HST value and price including HST will be calculated. Swear or affirm the estimated value of the estate stated on your application form.

The following table provides the GST and HST provincial rates since July 1 2010. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or. This rate is the same since july 1st 2010.

13 for Ontario 15 for others If you want a reverse HST calculator the above tool will do the trick. Provinces and Territories with HST. No change on the HST rate as been made for Ontario in 2022.

The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST. 2022 Ontario tax tables with supporting Ontario tax. The HST for Ontario is calculated from Ontario rate 8 and Canada rate 5 for a total of 13.

65000 - Taxes - Surtax - Health Premium - CPP - EI 48 05339 year net 48 05339 52 weeks 92410 week net 92410 40 hours 2310 hour net. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. This free calculator is handy for determining sales taxes in Canada.

The tax rates for Ontario in 2021 are as follows. Amounts above 45142 up to 90287 are taxed at 915.

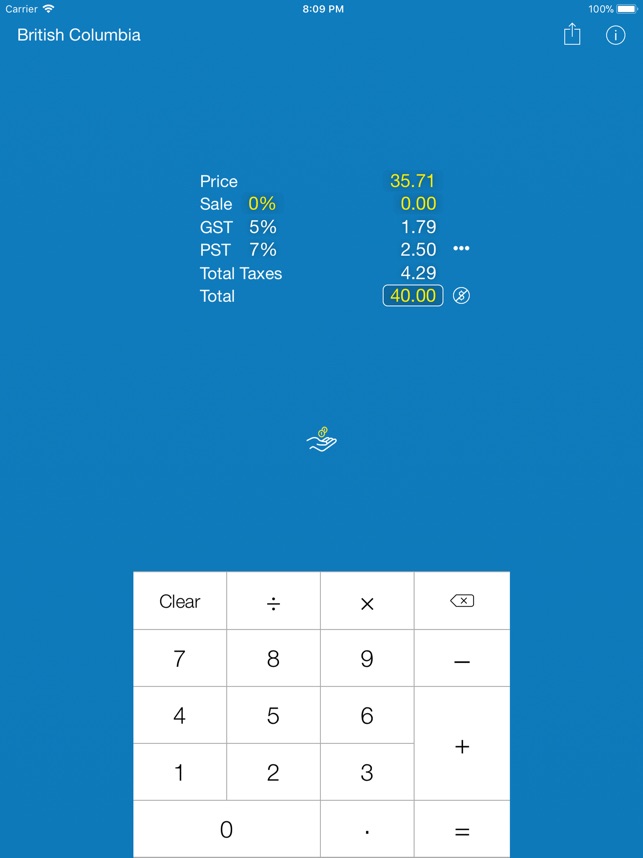

Sales Tax Canada Calculator On The App Store

Yukon Gst Calculator Gstcalculator Ca

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Canada Sales Tax Gst Hst Calculator Wowa Ca

2021 2022 Income Tax Calculator Canada Wowa Ca

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Ontario Income Tax Calculator Wowa Ca

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Reverse Hst Calculator Hstcalculator Ca

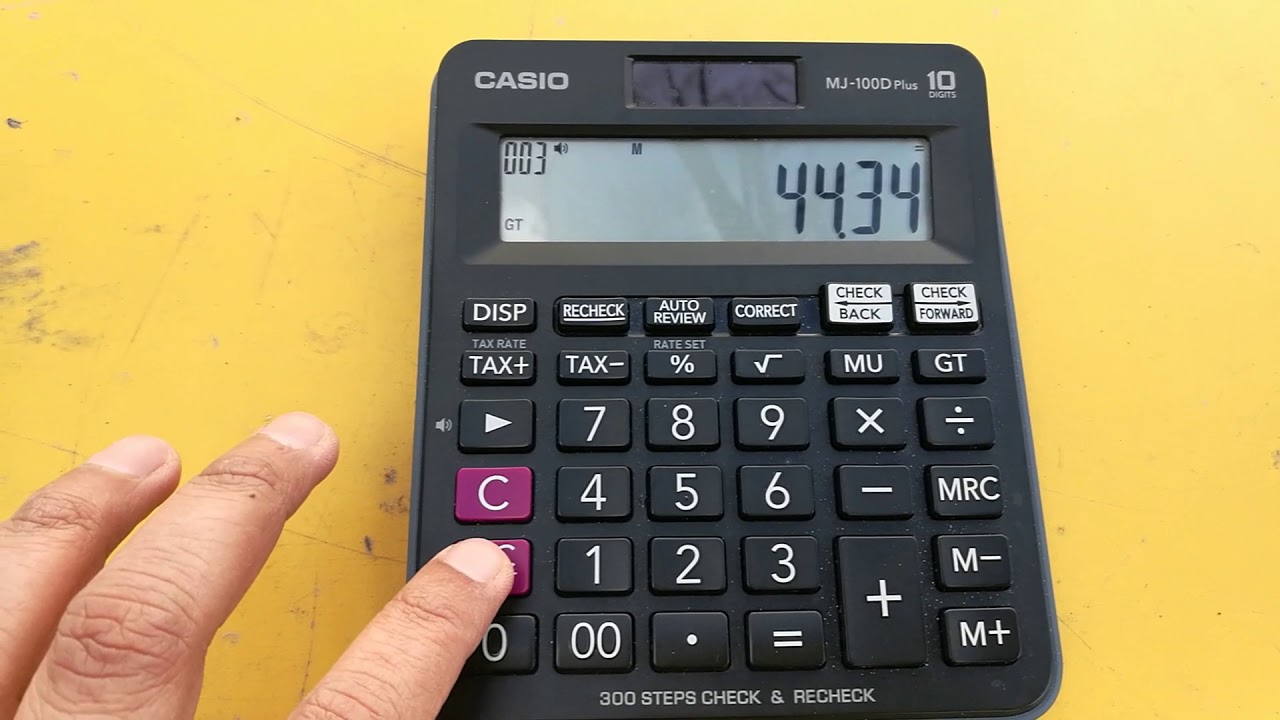

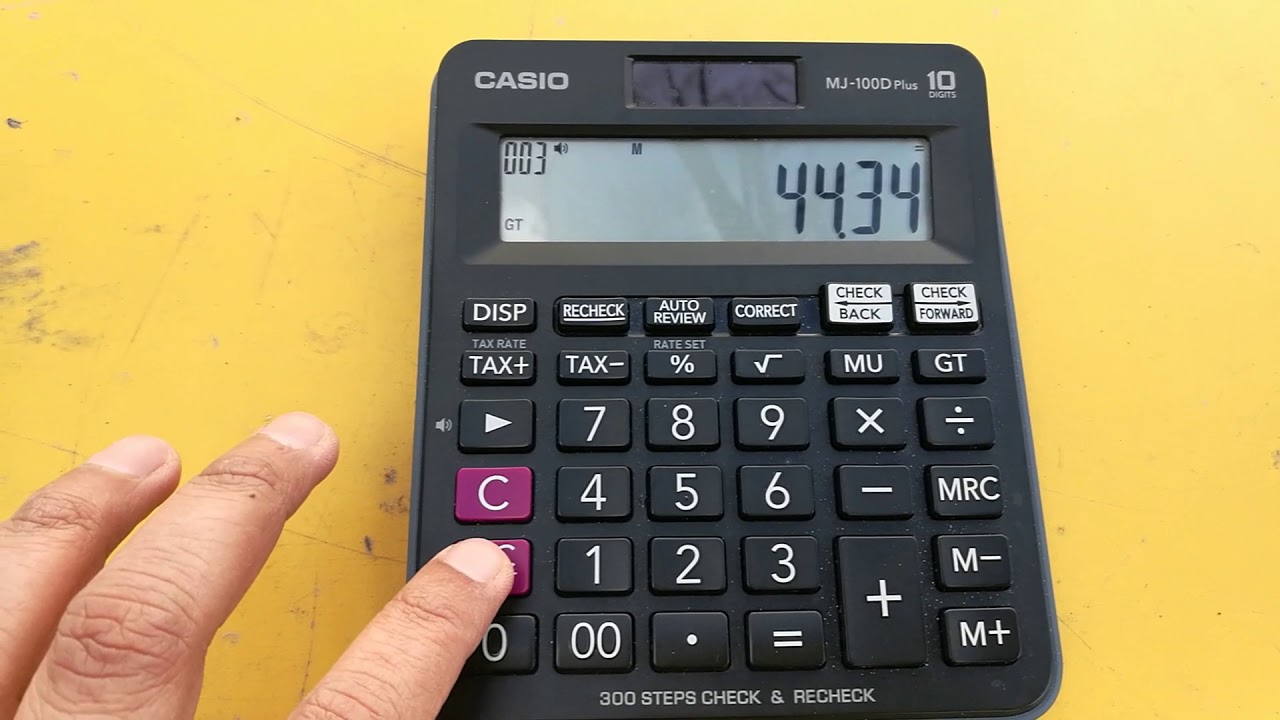

How To Calculate Sales Tax On Calculator Easy Way Youtube

Canada Sales Tax Calculator By Tardent Apps Inc

Updated Canada Sales Tax Calculator For Pc Mac Windows 11 10 8 7 Iphone Ipad Mod Download 2022

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Sales Tax Canada Calculator Free Download App For Iphone Steprimo Com

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

For Sale See 23 Photos 6190 Trillium Crescent Niagara Falls On 3 Bed 2 Bath 1350 Sqft House Mls 30798471 Market Niagara Falls Niagara Trillium

Want To Buy But No Down No Credit Bad Credit No Problem Classified Ad Bad Credit Bad Credit Score Loans For Bad Credit

Thought Of The Day Think Loan Think Sk We Are With You For All Your Loan Needs All Financial Service Under One R Financial Services Thought Of The Day Finance